Strategic Capital Solutions

Tailored to fit your needsOur Typical Investment Structures

We offer a wide range of capital solutions including three primary investment programs customized to fit your needs.

1

Private Debt

Loan Size: $1 – $6 Million

Leverage: Up to 65% LTV / 70% LTC

Rate: Fixed Rate starting at 10-14%; (Floating Rates also available)

Term: Range from 2 to 4 years

Prepayment: Flexible / Yield Maintenance. Target lockout of 9 – 12 months

Guarantee: Flexible – Recourse or Non-recourse to key principals with standard carveouts

Fees: Origination & Exit Fees determined on deal-by-deal basis, typically 2 – 4%

Asset Class: Income producing commercial loans to fund acquisitions, construction projects, real estate, equipment, inventory, or working capital needed for growth.

2

Mezzanine Loan

Loan Size: $1M to $6M

Leverage: Up to 60-70% LTC / LTV

Rate: 14 – 18%, typically 10 – 12% current pay with remaining at maturity

Term: Range from 1 to 4 years

Prepayment: Flexible / Yield Maintenance

Guarantee: Flexible – Recourse or Non-recourse to key principals with standard carveouts

Fees: Origination & Exit Fees determined on deal-by-deal basis, typically 2-4%

Asset Class: Income producing commercial loans to fund acquisitions, construction projects, real estate, equipment, inventory, or working capital needed for growth.

3

Preferred Equity

Size: $1 – $3 Million

Leverage: Up to 50% Equity

Pricing: 16% IRR, with a minimum multiple at exit

Term: Range from 2 to 3 years

Fees: Typically, 2-4%

Asset Class: Income producing to fund acquisitions, construction projects, real estate, equipment, inventory, or working capital needed for growth.

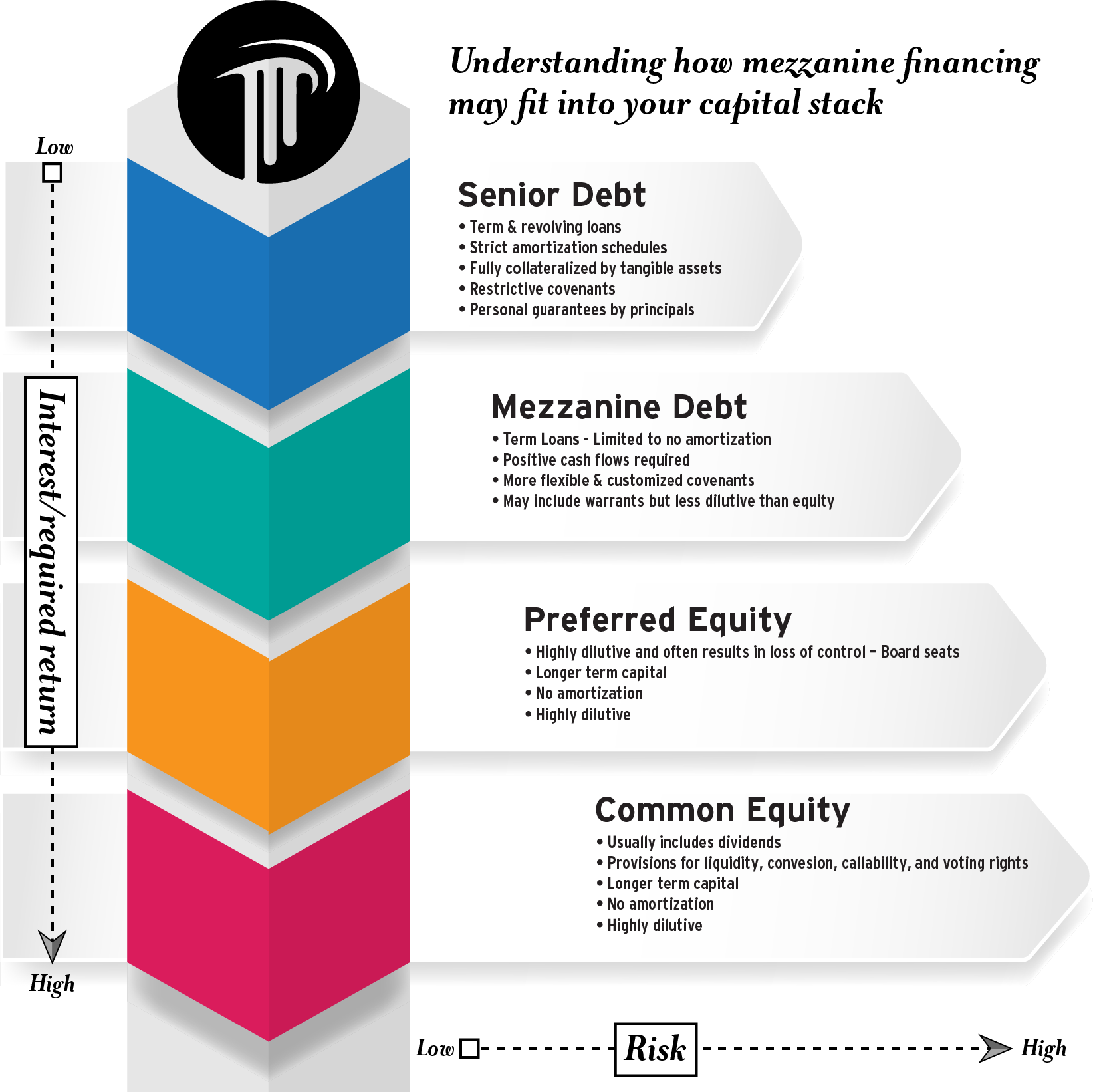

Background on Mezzanine Debt

Senior Debt

In today’s environment, traditional senior debt can be very challenging to obtain requiring significant collateral including personal guarantees, likely interest rates in the mid-single digits and more restrictive covenants.

Likely Interest rates in the mid-single digits but will include more restrictive covenants.

No Dilution

Mezzanine Debt

Mezzanine Financing is often the best alternative to senior debt and equity. Mezzanine debt is typically more flexible regarding collateral, interest rates in the low to mid-teens, and usually with less dilutive forms of equity such as warrants.

A capital solution that avoids given up large portions of equity.

Limited Dilution

Equity

When a company doesn’t have the hard assets or necessary collateral for traditional bank debt, they will often turn to equity.

Equity financing may provide the most flexible liquidity in the short-term but in the long-term may be the most expensive.

Highly Dilutive